There is an old joke about an economist strolling down the street with his companion. They come upon a $20 bill lying on the ground, and as the companion reaches down to pick it up, the economist says, “Don’t bother, if it were a real $20 bill, someone would have already picked it up.”

This tale is a classic representation of one of the most contested beliefs in social science: the Efficient Market Hypothesis. This theory posits that consistent excess returns in financial markets are impossible. The rationale is quite simple: because there is a huge amount of market participants – who all have instant access to the same information – any mispricing is quickly exploited and arbitraged away.

Led by Nobel Prize winner Robert Shiller, countless scholars have found major anomalies in the efficient market theory. Nowadays, it is almost unanimously accepted that the theory does not hold. Educated investors now favor the idea that human emotions influence the market far more than rational decision-making. In order to exploit market inefficiencies, investors have invented a wealth of new investing strategies: value, growth, GARP (a combination of value and growth), income, “behaviouralizing,” etc. Each school of thought believes it has found the best stock picking technique. However, the truth is that it has become increasingly difficult to beat the benchmarks and outperform exchange-traded funds (ETFs).

A study recently published by a group of fund managers suggests many of us have missed the easiest yet most counter-intuitive investment strategy: trend-following. The authors prove that it is profitable to buy stocks when their price has appreciated, and short the ones that are declining. In other words, the study contradicts the oldest mantra in the book and defends the absurd theory to “buy high and sell low.”

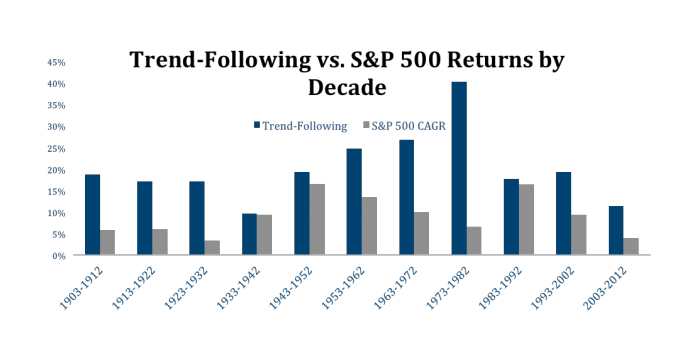

This investment strategy consists of going long on assets with prices above their previous five-month average, and shorting them when they fall below their average. The results are impressive. The authors reverse-tested their strategy two hundred years back and showed profitable returns every single decade. Trend-following beat a classical 60/40 portfolio in every period, and proved to be more profitable than buying and holding the assets based on P/E valuation.

Although the results are somewhat head-scratching, there is a compelling explanation for this phenomenon. Academics like to call it the principal-agent problem. Up until the 1980s, individual investors held more than three-quarters of the world’s financial assets. However, nowadays, most stocks are not held by investors themselves, but by agents that invest it for them through asset management in mutual funds and hedge funds, for example. These big players now account for 30-40 percent of daily trading on Wall Street and, therefore, have a major impact on markets dynamics.

The nature of their business is at the root of the trend-following phenomenon. Investors pick their fund managers based on past performance. They choose to give their hard-owned capital to “superstar managers” who have been able to consistently beat their peers and the benchmark. The massive capital outflow from Pimco – estimated at $100 billion – following the departure of Bill “the Bond King” Gross serves as a perfect example. Fund managers are highly pressured to never underperform their benchmark (e.g. S&P 500, Dow Jones Industrial Average, etc.), or else they lose their clients. The most damaging situation for them is to have an underweight position in an outperforming index stock. It causes their returns to rapidly diverge from the benchmark if they do not invest in the rising stock. Consequently, large fund managers are forced to allocate massive amounts of capital in financial assets with rapidly rising prices, even if they clearly appear to be overvalued. These irrational price momentums are what allowed trend-followers to pocket massive profits.

Also, the large sums given to big name money managers are invested in the stocks and bonds that they favour, which are most likely those that have performed well recently. This leads to excessive price increases in their preferred assets. In addition, a growing number of investors have developed a copycat-bias; they systematically replicate every move of their idolized managers. This has also contributed to irrational price and volume increases, and thus the high profitability of the trend-following strategy.

Still, some economists argue that the perceived impact of fund managers on the market is exaggerated. For them, trend-following has been profitable because of a recent phenomenon: massive stock repurchases. Last year S&P 500 companies bought back a record-level of $500 billion of their own shares. This increases earnings per shares, which has become an indication of a firm’s financial health for many uneducated investors. Academics argue that constant EPS increases have fueled sustained stock price surges, even if every valuation metric suggests a market correction.

The shift in dynamics from individual to fund-dominated markets is undeniable. However, only time with tell us if this trend-following strategy can bring excess return in the long-term.

You can try buying high and selling low at your own risk, but I personally wouldn’t break my piggy bank to test it just yet. Instead, next time you see a $20 bill on the floor, you better pick it up quick because it won’t be there for long. Also, take the time to look around, as there are most likely quite a few 20$ – or even $100 bills – lying around. The market is still full of bargains, you just need to dig a little.