FinTech is gaining weight and increasingly cooperating with traditional banks in many countries. However, the adoption in the Canadian banking industry has been slower because of weak consumer awareness and resistance from traditional banking players.

In the Banking Industry, Digital Disruption is Yet to Come

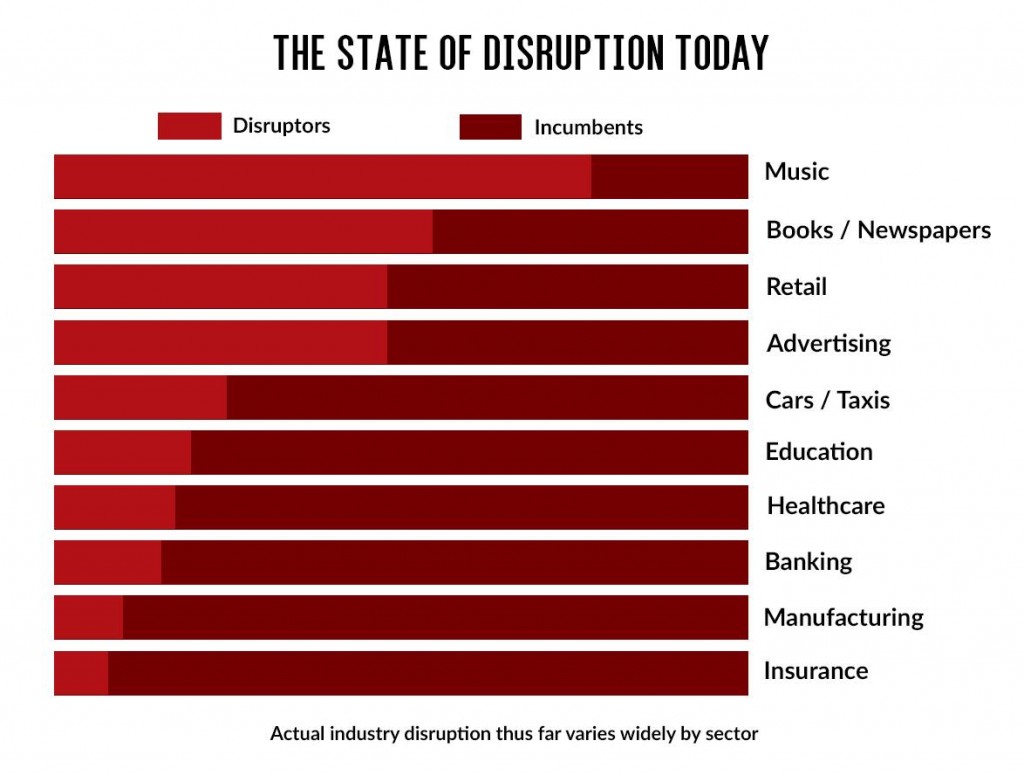

In recent years, new technologies have disrupted numerous industries, along with having changed the overall consumer experience. However, as a report by the Leading Edge Forum (LEF) highlights, digital disruption impacted different sectors disproportionately.

According to LEF, the music industry experienced the most drastic transformation. The first disruptive wave was when Amazon and iTunes entered the industry with their online purchasing platform. The second one was the trend of subscription services such as Spotify and Deezer.

The publishing industry ranked second. The increasing popularity of eBooks and online subscriptions revolutionized the reading experience.

Towards the end of LEF’s list we find the banking industry, slightly before insurance and manufacturing; despite a strong potential for disruption, banking has been relatively untouched.

There are several reasons for this:

First, the low disruption witnessed in banking can be partly explained by the existence of strong regulations in the industry – a direct consequence of the most recent financial crisis. Such regulations created barriers to entry particularly difficult to overcome for disruptors.

Second, the banking system is oligopolistic in nature, making it even more difficult for new players to compete against banking giants.

Third, big banks’ legacy technology systems render their structure rigid, thus making innovation relatively difficult to implement.

Security and privacy are big concerns for customers when it comes to trusting new and untested technologies to manage their savings and investments. The mysterious vanishing of $350 million worth of bitcoins in the Japanese MT Gox bitcoin currency exchange in February 2014 is one example (among many others) of the security concern brought on by new technologies.

Last but not least, it is not necessarily in the banks’ interest to innovate.

According to a recent SunTec report, “Customers do value services which save costs and increasingly, time. The rise of banking apps and online banking are examples of innovations in the sector. From a bank[’s] perspective these are additional costs, which do not guarantee more revenue.[They] are increasingly seen as status quo services and are additional ‘opportunities to fail’ on customer service.”

Banks make a big chunk of their profits from the transaction fees they charge as part of their payment systems. However, Financial Technology (FinTech) startups are inventing cheap and convenient alternatives. This poses a direct threat to banks’ profitability, as transactions and other procedural fees are eliminated.

Today’s sense of accelerating disruption is gaining momentum and it is logical to expect that more is on the way. In other words, many believe that the industries which have so far stayed dominantly traditional (despite the rise of new technologies) are about to experience great disruptions.

There are many reasons to believe that the banking system will follow this expected pattern, as financial technology startups are gaining territory and threatening the current banking model. The question is: should banks partner with or compete against potential disruptors?

Source: Leading Edge Forum

The Future of the Banking Industry: Towards “Fintegration”

In the past five years, more than $25 billion have been poured into FinTech, according to a report by The Economist Intelligence Unit. This makes it a prime target for venture funding.

Traditional banks see the rise of FinTech startups more as a threat than an opportunity to modernize their business. According to a study from Goldman Sachs, FinTech startups are about to steal away up to $4.7 trillion worth of business. This sentiment is widely spread among traditional players: “They all want to eat our lunch. Every single one of them is going to try”, Jamie Dimon, the CEO of J.P. Morgan told his shareholders about FinTech firms.

“The potential for disruption is strong across the entire banking industry value chain. We expect increasingly fierce competition between traditional banking incumbents and emerging financial technology [FinTech] players,” highlights LEF research director David Moschella.

Peer to peer lending, mobile banking, blockchain (the technological innovation that underlies Bitcoin), and other such innovations are making financial services cheaper and more customer-friendly. For example, in foreign exchange payments, startups are matching individual holders of euros and dollars to lower exchange fees by 90%, according to The Economist Intelligence Unit. Overall, startups are re-imagining financial services in ways that banking giants can no longer ignore.

While a disruption can provoke important challenges for traditional players, FinTech startups are not a direct threat to their existence. As of today, FinTech accounts for less than 2% of the market. This share is expected to increase greatly in the future, but even FinTech executives expect banks to stay the dominant players for some time.

“Lots of banks have such incumbency advantages that it is hard to see a startup beat them head on. Instead we’re seeing more FinTech players and banks working together to deliver innovative solutions and superior customer experiences,” says Sam Hodges, co-founder and U.S Managing Director of Funding Circle.

BI Intelligence forecasts that traditional institutions will respond to the threat created by the disruptors by partnering with them. This is because it will most likely prove easier for banks to integrate innovative services developed by startups rather than to build them in-house while still competing against startups

And FinTech and traditional players do complement each other’s business to some extent. FinTech startups generally offer a single product, while customers prefer having all their banking needs met under one roof. It is remarkably difficult for start-up companies to build common platforms: if they significantly grow in size, they may have to comply with new sets of regulations. Such compliance would offset their predominant advantage – their flexibility. For this reason, startups need the integrated platforms and service offerings of banks to make their innovations appealing to customers. Inversely, banks need the startups to keep up with innovation and stay competitive in an increasingly complex industry.

Therefore, it seems that “fintegration” – the merger of financial services and digital technology – is on the way.

Why is the Canadian Banking System Lagging Behind in Terms of Innovation?

According to the Ernst & Young LLP’s FinTech Adoption Index, the FinTech adoption rates (measured as the percentage of digitally active people who used at least two FinTech services in the last 6 months) are the following: 29% in Hong Kong, 17% in the United States, 14% in the UK, 13% in Australia, and only 8% in Canada – well below the other countries’ average of 16%.

Canadian banks are reluctant to adopt FinTech technologies because they see them as a threat, which may explain the low FinTech adoption rate observed.

In effect, FinTech and traditional banks are competing for talents in Canada. “When we want to make a change we talk about it in the morning and we’re building in the afternoon,” comments Darryl Knopp, who left the financial services industry after a 20-year career to take a job in Vancouver-based online lender Grow. “That’s an inspiring environment. It’s very difficult to do that at large institutions.”

FinTech also threatens Canadian banks’ business model. In particular, innovative products developed by startups reduce drastically the transaction costs incurred by customers; these costs are an important source of revenues for traditional banks. Peter Routledge, Chief Financial Services Analyst at National Bank, explained during an interview for BNN that FinTech was a serious threat for Canadian banks. He explained that while in other countries banks agreed to cooperate with FinTech firms such as Apple, he was glad to see that it was not the case in Canada. In effect, he believed that such cooperation with Apple would infringe on the banks’ relationship with its customers (for example, the increased FinTech companies would have to banks’ customer base). By cooperating with FinTech companies, banks are indirectly accepting to lower their margins. This goes against the banks’ mission of profits for its shareholders, according to Peter Routledge.

Illustration by: Lisa El Nagar

Additionally, the lack of consumer awareness of the different options offered by FinTech providers plays a role in explaining Canada’s low FinTech adoption rate.

“In Canada, the strength and breadth of our traditional financial services institutions means that it’s just that much harder for a smaller FinTech company to make itself a household name,” says Gregory Smith, partner at EY’s financial services advisory practice. “But FinTech in Canada is still quite new and it certainly plays a role in awareness. I suspect as [FinTech’s] customer base grows, awareness will significantly increase as well.”

Consequently, adoption could triple over 2016; the younger generations are already familiar and comfortable with FinTech technologies, the increase would come primarily from Canadians over age 55 and earning more than USD 150,000 a year, according to Ernst & Young.

Canada is lagging behind when it comes to FinTech adoption, but probably not for long. For now, Canadian banks feel threatened by the potential of the Fintech industry, and for legitimate reasons. However, a strategic response may be to start working hand in hand with Fintech startups before it is too late for them to react to the disruptive trend that has already started changing their industry.