It is estimated that every dollar invested in the Canadian oil sands will create about $7.50 in total economic impact over the following 25 years. During the second quarter of 2013, Warren Buffet’s Berkshire Hathaway reportedly bought a $500 million stake in Calgary-based heavy-oil producer Suncor Energy. Although this represents a transaction on the secondary markets, it can be ultimately viewed as a capital inflow for the Oil Sands industry. So while you try reaching Warren Buffet to thank him for indirectly contributing $3.75 billion to the Canadian economy over the next 25 years, let’s follow the money and “drill” deeper into the underlying sector fundamentals behind this investment.

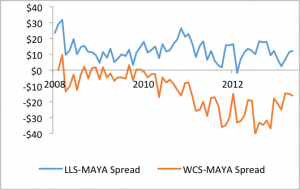

Over the past 2 years, there has been a lack of transportation capacity from Western Canada to refineries in North America. This has led to a discrepancy in heavy oil prices across geographic regions. Looking at data since 2011, the differential between the Western Canadian Select, a benchmark for heavy oil prices in western Canada, and the Mexican Maya, a crude oil of approximately equivalent grade quoted at the gulf coast, has expand from an average of just -$3.8 during 2008-2010 to an average of more than -$23.5 since 2011 (Chart 1). Depressed WCS prices meant lower realized oil prices and hence depressed valuations among Canadian oil companies, mainly heavy oil ones.

This represents an arbitrage opportunity to transport Western Canadian Select to the Gulf Coast and pocket $23.5 less the transportation costs. But what happened to free markets’ aptitude to exploit and diminish arbitrage opportunities?

Truth be told, the free markets’ aptitude to exploit arbitrage opportunities is very much still in existence. The reason prices across the two markets have not converged is because there is a lack of oil transportation capacity between Western Canada and the Gulf Coast. However, the market is becoming more innovative in searching for solutions. Energy East is building a west to east pipeline that would carry 1.1 million barrels of oil per day, and the novel crude-by-rail transportation method is growing fast. It is estimated that more than 700,000 barrels per day of rail transportation capacity is to become available in western Canada by end of 2014.

Even if the no new pipelines are approved, the addition of rail capacity could result in the price differential narrowing down to $15-20 per barrel, equal to the average cost of transporting crude by rail from Western Canada to the Gulf Coast.

So the price differential between WCS and MAYA is essentially equal to the transportation cost of moving oil from Western Canada to the Gulf Coast. With that being said, there is no real arbitrage opportunity since anyone who buys oil at lower Western Canada prices must fork out additional transportation costs which are virtually equal to the price premium in the Gulf Coast. There is no free money to be made.

There are two possible scenarios for the future of WCS heavy oil prices. Either the differential settles down to $15-20 with the arrival of rail transportation capacity through the end of 2014. Or, the government approves major pipeline projects, such as Keystone XL, Energy East or Trans Mountain, reducing the transportation cost to $7-11 per barrel. If the latter turns out to be the case, then the price differential between the two markets should narrow even further to just $7-11 apart.

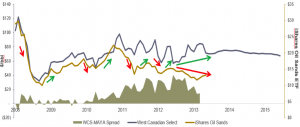

The result of all of this? Trading at a differential equal to rail transportation costs or pipeline tolls, the WCS-MAYA differential is set to narrow and data over the past few months reflect that. However, although Oil Sands equities are intended to track WCS prices, the relationship broke around August 2012 and oil sands valuation have not reflected WCS spot movements and WCS futures. In simple terms, WCS spot and future prices are on the rise, and this should cause oil sands company valuation to rise as well – but this has not happened. This can be explained by Mr. Market dreading uncertainty and hence depressing oil sands valuations.

Now that we know what Buffett sees and Mr. Market doesn’t, please do thank Warren Buffett and send him my warm regards.

Disclosure: I am Long Suncor Energy (NYSE: SU) since November 2012.